Buy or Rent After Selling Your House: What Should You Do?

Are you someone who’s lived in your current house for a while and feels the itch for a change? Thinking about selling your house? There’s much to ponder over. Will you relocate to a different state or stay in the vicinity? Is it the right time to downsize, or perhaps you need more room for your growing family? One of the significant decisions you’ll face is: Should you buy your next home or opt to rent?

Your choice will hinge on your present circumstances and your future aspirations. Consider these two pivotal factors:

Expect Rents to Keep Going Up

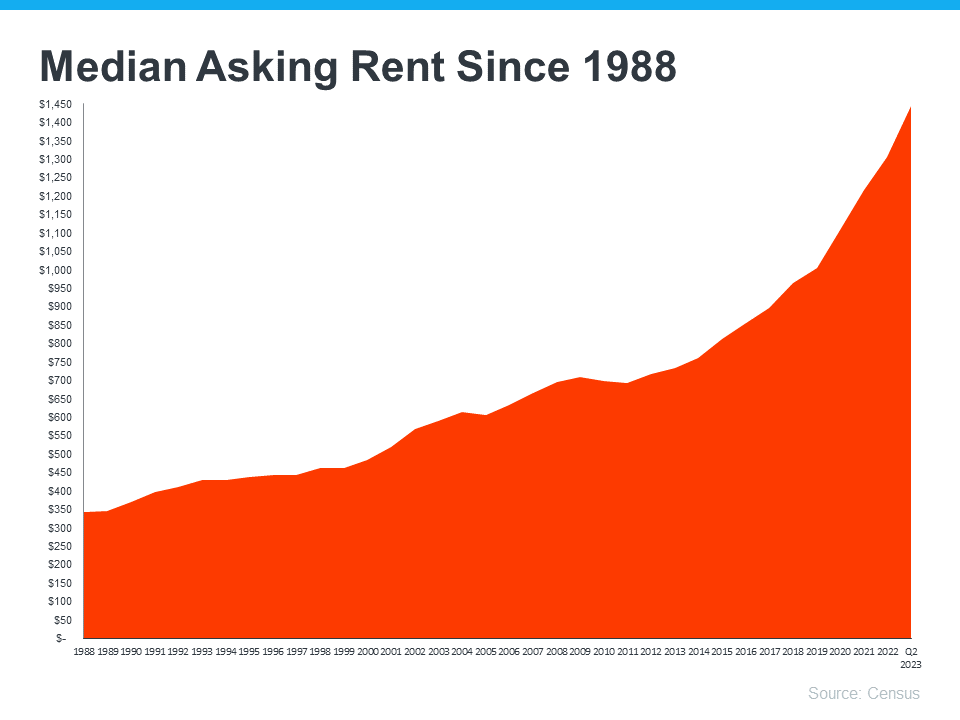

The graph below uses data from the Census to show how rents have been climbing steadily since 1988:Rents have been going up consistently over the long run. If you choose to rent, there’s a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year.

The graph below draws from Census data, illustrating that rents have consistently risen since 1988. If you decide on renting, be prepared for a potential hike in your rental payment with each lease renewal. An escalating rental cost may not be an annual event you’d be keen on.

“. . . homeowners with fixed-rate loans will witness minimal fluctuations in their monthly housing expense over their loan’s duration. This offers peace of mind, knowing that while other costs might shift, your mortgage remains steady.”

The Advantages of Owning Your Home

According to AARP, in the long run, buying often trumps renting:

“While both choices have their set of advantages and drawbacks, owning a home often presents a more extensive list of positives.”

To better guide your decision post-sale, here are a few perks of homeownership:

- Financial Future: Owning a home can be a strategic move for future savings. The equity you accumulate as a homeowner can pave the way for generational wealth, providing subsequent generations with improved prospects.

- No Monthly Payments: Should you possess enough equity to purchase your subsequent home outright, you’d be free from monthly mortgage payments. Although property taxes and maintenance fees might still be on the table, the absence of a mortgage payment offers significant relief.

- You might not have to pay a monthly mortgage payment at all. If you have enough equity to buy your next home outright, you wouldn’t have a monthly mortgage payment. While you might still need to cover property taxes or maintenance fees, not having to worry about a monthly mortgage payment could be a big relief.

- Customization and Aging in Place: Owning your property grants you the liberty to renovate and adjust according to changing needs, simplifying life as you age or as your family evolves.

Bottom Line

If you’re on the fence about buying or renting your next place, let’s connect. With the trajectory of rising rents and the numerous advantages homeownership offers, buying might be the right step for your future.

![20230913-Should-Baby-Boomers-Buy-or-Rent-After-Selling-Their-Houses[1]](https://www.sullivanr.com/wp-content/uploads/2023/09/20230913-Should-Baby-Boomers-Buy-or-Rent-After-Selling-Their-Houses1.png)